Adjusting Entries: Types, Examples, and Financial Impact

After 60 months, the balance in the Accumulated Depreciation account is $6,000 and therefore the equipment is fully depreciated and has no value. After the asset is fully depreciated, no further adjusting entries are made for depreciation no matter how long the company owns the asset. You had purchased supplies during the month and initially recorded them as an asset because they would last for more than one month. By the end of the month you used up some of these supplies, so you reduced the value of this asset to reflect what you actually had on hand at the end of the month ($900).

Unearned Revenues

Choosing an inappropriate method or failing to update the useful life of an asset can result in incorrect expense allocation. For instance, using the straight-line method for an asset that experiences rapid wear and tear may understate the depreciation expense in the early years and overstate it in the later years. This misalignment can affect both the income statement and the balance sheet, leading to a skewed representation of the company’s financial health.

Example of an Adjusting Journal Entry

When deferred expenses and revenues have yet to be recognized, their information is stored on the balance sheet. As soon as the expense is incurred and the revenue is earned, the information is transferred from the balance sheet to the income statement. Two main types of deferrals are prepaid expenses and unearned revenues. When a company purchases supplies, the preparing adjusting entries original order, receipt of the supplies, and receipt of the invoice from the vendor will all trigger journal entries. This trigger does not occur when using supplies from the supply closet. Similarly, for unearned revenue, when the company receives an advance payment from the customer for services yet provided, the cash received will trigger a journal entry.

Depreciation Expense

When deferred expenses and revenues have yet to berecognized, their information is stored on the balance sheet. Assoon as the expense is incurred and the revenue is earned, theinformation is transferred from the balance sheet to the incomestatement. Two main types of deferrals are prepaid expenses andunearned revenues. Adjusting entries include accruals for revenue and expenses, deferrals for prepayments, estimates for depreciation and provisions for doubtful accounts. These entries align financial statements with actual economic activity, ensuring accurate and transparent reporting.There are six types of adjusting entries. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

What Are the Types of Adjusting Journal Entries?

Similarly, expenses that are not properly matched with the corresponding revenues can distort the net income figure, misleading investors and other stakeholders. Adjusting entries are necessary to ensure that financial statements accurately reflect a company’s financial position. These entries are made at the end of an accounting period to record transactions that have occurred but have not yet been recorded.

- For example, if an adjustment entry is made to adjust the balance of a particular account that is related to a specific fiscal year, this will impact the financial statements for that fiscal year.

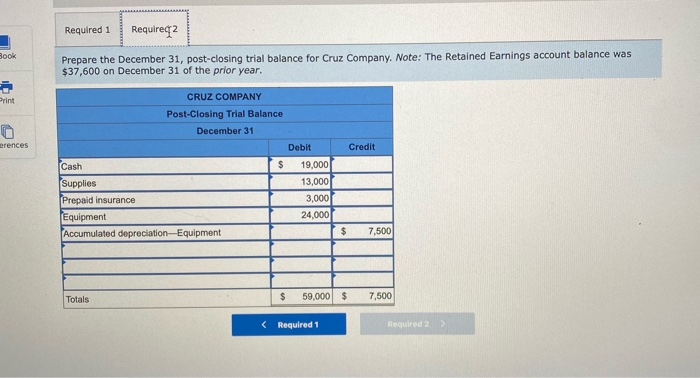

- Then after your adjusting entries, you’ll have your adjusted trial balance.

- You prepaid a one-year rent policy during the month and initially recorded it as an asset because it would last for more than one month.

- To record a deferral, an accountant would debit an asset account and credit a revenue or expense account.

Types of Adjustment Entries

Adjusting entries are the changes you make to these journal entries you’ve already made at the end of the accounting period. You can adjust your income and expenses to more accurately reflect your financial situation. The point is to make your accounting ledger as accurate as possible without doing any illegal tampering with the numbers. You have your initial trial balance which is the balance after your journal entries are entered. Then after your adjusting entries, you’ll have your adjusted trial balance.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. If the Final Accounts are prepared without considering these items, the trading results (i.e., gross profit and net profit) will be incorrect.

By the end of the month some of the insurance expired, so you reduced the value of this asset to reflect what you actually had on hand at the end of the month ($1,100). To transfer what expired, Insurance Expense was debited for the amount used and Prepaid Insurance was credited to reduce the asset by the same amount. Any remaining balance in the Prepaid Insurance account is what you have left to use in the future; it continues to be an asset since it is still available. The first journal entry is a general one; the journal entry that updates an account in this original transaction is an adjusting entry made before preparing financial statements.

The salary the employee earned during the month might not be paid until the following month. For example, the employee is paid for the prior month’s work on the first of the next month. The financial statements must remain up to date, so an adjusting entry is needed during the month to show salaries previously unrecorded and unpaid at the end of the month. For example, a company pays $4,500 for an insurance policy covering six months. It is the end of the first month and the company needs to record an adjusting entry to recognize the insurance used during the month.

The following entries show the initial payment for the policy and the subsequent adjusting entry for one month of insurance usage. Depreciation may also require an adjustment at the end of the period. Recall that depreciation is the systematic method to record the allocation of cost over a given period of certain assets.

Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate. These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year. Adjustment entries are made at the end of an accounting period, which can impact the timing of when revenue and expenses are recorded. For example, if an adjustment entry is made to defer revenue to a future accounting period, this will delay the recognition of revenue until the future period. In the balance sheet, adjustment entries are used to update the values of assets and liabilities. For example, if a company has an account receivable that is unlikely to be collected, an adjustment entry is made to reduce the value of the asset.